Family-owned businesses are the backbone of the global economy, representing enduring values, legacy-driven leadership, and a unique style of corporate governance that blends tradition with innovation.

Importance of Family-Owned Businesses

Family businesses account for more than 70% of global GDP and about 79% of India’s GDP alone, making them the largest economic contributors in almost every country. These businesses—often passed down generations—serve as a bridge between the past and the future, preserving trust, stability, and community engagement. In the UAE, family businesses contribute nearly 40% of GDP and are vital for national employment and economic resilience.

Global Economic Contribution

The world’s 500 largest family businesses, including household names like Walmart, Tata, Reliance, and Mitsui, collectively generate US$8.8 trillion in annual revenues, rivaling the GDP of major nations. Family enterprises dominate sectors such as retail, consumer goods, manufacturing, and hospitality, driving innovation, job creation, and intergenerational wealth.

Family businesses are often more resilient in crises, as demonstrated during the COVID-19 pandemic, global financial downturns, and disruptive market changes.

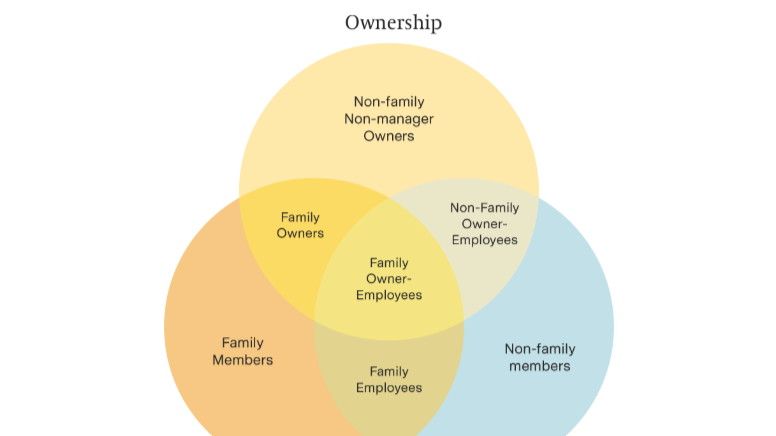

Governance Style and Succession

Family businesses thrive on values-based governance, blending discipline with flexibility. Models such as the Tata Code of Conduct, Aditya Birla Group’s trusteeship, TVS’s decentralised but collective accountability, and the Rothschild partnership illustrate robust frameworks for managing succession, conflict, and innovation.

Key governance tools:

- Family councils and assemblies to facilitate decisions and succession

- Institutionalized codes of conduct and charters balancing ethics and financial prudence

- Professionalisation alongside family oversight, ensuring credibility and business continuity

- Succession planning via mentorship, transparent processes, and capability-based leadership (Rothschild, Mitsui, Godrej)

Governance mechanisms found in UAE and Gulf region family businesses now include legal frameworks for dispute resolution, multi-class shares, buyback options, and tailored profit-sharing arrangements, enhancing adaptability and market competitiveness.

Lessons Learned from Family Businesses

Resilience and Adaptability: Long-lived family firms show an extraordinary ability to survive wars, recessions, and technological disruptions. For example, Mitsui (Japan) transitioned from a family-led group to a keiretsu with systemic governance, while the Rothschild dynasty institutionalized unity and partnership agreements to avoid fragmentation.

Trust and Reputation: Family businesses often emphasise ethics and community stewardship, as seen with Tata and Godrej’s reputation for fair practices and corporate social responsibility. These values create a “protective moat” around brands, enabling sustainable success.

People-First Culture: By prioritizing employee welfare, gender inclusivity, and community development (see Godrej’s housing colonies and skills programs), family businesses foster loyalty and stability, even in turbulent times.

Decentralisation Combined with Unity: TVS group’s governance structure allows entrepreneurial freedom while maintaining unified ethical standards, preventing family feuds and reinforcing brand reputation.

Professionalisation and Institutionalisation: Modern family business governance, especially in the UAE and Gulf, now blends professional management with founder oversight to ensure succession does not undermine continuity.

Family-owned businesses in the UAE and Saudi Arabia are central pillars of their economies, deeply rooted in cultural heritage while actively embracing innovation and sustainability. In the UAE, family businesses account for about 90% of the private sector and contribute nearly 40% of the national GDP, employing over 70% of the workforce. These enterprises, many led by second and third generations, face key challenges like succession planning and governance but benefit from supportive legal frameworks such as the UAE Family Business Law. Saudi family businesses, with groups like Al Muhaidib and Abdul Latif Jameel leading the way, dominate the region alongside UAE firms like Al-Futtaim. Al Rostamani and DAMAC, blending tradition with modern strategies including investments in clean energy and digital transformation. Collectively, family businesses in both countries are not just economic drivers but also custodians of social stability and long-term legacy, poised for sustainable growth amid evolving market dynamics.

UAE and Gulf family businesses have rapidly modernized, embracing legislative reforms (Federal Decree-Law No. 37/2022), digital transformation, and global partnerships while maintaining heritage governance features. Firms like Al-Futtaim combine innovative business models with strong family values, contributing significantly across sectors.

Governance Lessons and Modernization

UAE legislation such as Federal Decree-Law No. 37/2022 is pivotal in regulating ownership and multi-generational transfer for family businesses. It introduces structures for share classes, tailored voting, profit sharing, and mechanisms for resolving shareholder disputes, all supporting business continuity and competitiveness globally.

Family businesses are the silent engines of prosperity, weaving together legacy, innovation, and stewardship. Their success lies not just in financial acumen but in the thoughtful transmission of values, trust, and a people-centered approach to governance. This makes them uniquely poised to adapt, endure, and lead—across industries and generations.

“Governance is not just a system but a culture. It is about stewardship, not control. It is about trust, not power. It is about continuity, not merely compliance. Values, when practiced with integrity and foresight, don’t just make businesses successful—they make them timeless.”